Content

It is a violation of law in some juristictions to falsely identify yourself in an email. All information you provide will be used solely for the purpose of sending the email on your behalf. The subject line of the email you send will be “Fidelity.com”. Suffice it to say, the kiddie tax can be complicated, but it has significant implications for both you and your child.

This can happen if you have a one-time increase in your investment income, say from selling inherited stock or an investment property. On the other hand, if any individual gives assets worth more than $15,000 to a recipient in 2019, a gift tax return must be filed. For the Holdens to give Hope shares with a $30,000 built-in gain, the value of the shares probably would be well over $30,000, requiring a gift tax return. By clicking „Find a Lawyer“, you agree to the Martindale-Nolo Texting Terms.

Understanding the Kiddie Tax

However, depending on your tax bracket, doing so can increase your tax burden — which means it could be a costly mistake. However, the Further Consolidated Appropriations Act of 2020 retroactively changed kiddie taxes back to the parent’s tax rate. For 2018 and 2019 tax returns, taxpayers could either use the estate tax rates or the parent’s tax rate for calculating the kiddie tax. From there, the next $1,100 worth of a child’s unearned income gets taxed at the child’s tax rate. The child’s tax rate is typically very low — and sometimes non-existent.

The tax law doesn’t aim to take money away from children. Rather, it’s there to prevent parents from exploiting tax loopholes. Keep reading to find out more about the kiddie tax, how it works, and everything you need to know. The child was a full-time student at least age 19 and under age 24 at the end of the tax year and the child didn’t have earned income that was more than half of the child’s support. The following two situations may affect the tax and reporting of the unearned income of certain children.

History of the Kiddie Tax

When you take money out for qualified education expenses, withdrawals are federal income tax-free. You may also get a state tax deduction for your contributions, and the account will be counted as a parental asset which can be beneficial when determining financial aid for college. Under this new regime, beginning 2018, a child’s income from IRA distributions, https://quick-bookkeeping.net/ interest and short-term gains will be taxed at the top federal rate of 37 percent once it exceeds $12,500. Comparatively speaking, the child’s married parents pay that rate of tax only on income above $600,000. The top long-term capital gains rate increases from 15 to 20 percent above $12,700 for a child, versus at $479,000 for the parents.

- Get the curated financial guidance you need with our monthly newsletter.

- The information herein is general and educational in nature and should not be considered legal or tax advice.

- It’s important for parents to understand what implications the kiddie tax has on their gifting and stock transfer plans.

- For this and other information on any 529 college savings plan managed by Fidelity, contact Fidelity for a free Fact Kit, or view one online.

- If you’re not filing jointly with your child’s other parent, you’re the parent whose tax rate would be used to determine the kiddie tax.

Compensation may factor into how and where products appear on our platform . But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like your Approval Odds and savings estimates.

How the Kiddie Tax Works

LevyA levy is a lawful process where the debtor’s property is seized when the debtor cannot pay the outstanding debts. It is different from liens, as a lien is only a claim against a property, whereas a levy What Is The Kiddie Tax And How Does It Work? is an actual property takeover to fulfill the obligation. The College Investor is an independent, advertising-supported financial media publisher, focusing on news, product reviews, and comparisons.

- There are other requirements for a child’s tax return to qualify to be included on a parent’s tax return.

- This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice.

- ‘Kiddie tax’ is the tax imposed on a child’s unearned income at their US parent marginal tax rates – also considering income from all other dependent children.

- Having an ITIN does not change your immigration status.

- If you’re an adult and you invest in assets on behalf of a child, the kiddie tax is something you’re going to need to be vigilant of.

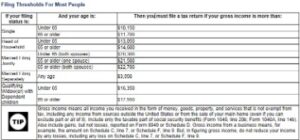

The „kiddie tax“ is a provision that taxes the unearned income of children under the age of 19 and of full-time students younger than 24 at a special rate. Under both the new law and the old, the first $1,050 of a child’s income is tax-free and the next $1,050 is taxed at a rate of 10 percent. The kiddie tax is a tax on a child’s unearned income. The Tax Reform Act of 1986 instituted this law, which reduces the incentive for people to shift their income to their children, thereby lowering their own taxable income. For 2020 and later tax years, children’s unearned income is taxed at their parent’s marginal tax rate. In 2019, Congress reversed changes the Tax Cuts and Jobs Act of 2017 had made to the kiddie tax.

No responses yet